In today's digital age, staying vigilant against sophisticated securities scams is vital to protect investments and avoid the high costs of breach of contract litigation. Be cautious of promises of high returns with minimal risk, conduct independent research, consult a financial advisor, and report suspicious activities. Proactive measures like these not only prevent financial loss but also shield you from the burdensome costs, complexities, and duration of legal battles stemming from breached contracts, which can run into millions of dollars.

In the dynamic financial landscape, investors must remain vigilant against cunning securities scams that rob them of their hard-earned money. This comprehensive guide, “Unveiling Common Securities Scams,” illuminates various fraudulent schemes plaguing the market. We delve into the devastating consequences, notably the substantial financial burden of litigating breach of contract cases resulting from these scams. Armed with knowledge and strategic defenses, investors can protect themselves against these heists, ensuring peace of mind in their investments.

- Unveiling Common Securities Scams: A Comprehensive Guide

- The Financial Impact: Cost of Litigating Breach of Contract

- Protecting Yourself: Strategies to Avoid and Report Fraudulent Activities

Unveiling Common Securities Scams: A Comprehensive Guide

Unveiling Common Securities Scams: A Comprehensive Guide

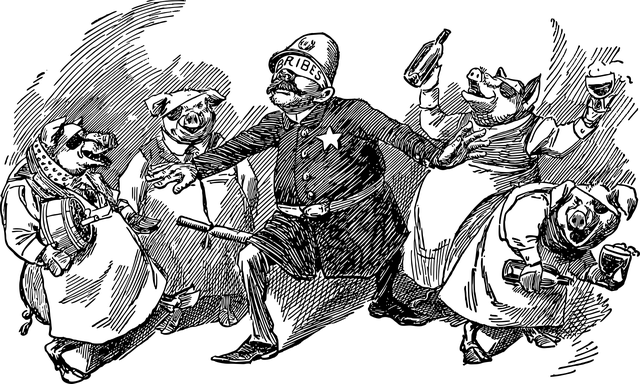

In today’s digital era, securities scams have evolved to become increasingly sophisticated and harder to detect. From elaborate Ponzi schemes to false promises of high returns, investors are constantly at risk of falling prey to unscrupulous individuals and organizations. Understanding these common scams is the first step in protecting yourself and your investments. By staying informed, you can avoid costly litigation arising from breach of contract and ensure peace of mind.

One of the most prevalent scams involves fraudulent investment opportunities that promise substantial returns with minimal risk. Scammers often target both corporate and individual clients by using persuasive marketing tactics and false testimonials. To safeguard yourself, always verify the legitimacy of an investment opportunity through independent research and consult with a reputable financial advisor. Remember, if it sounds too good to be true, it probably is. This proactive approach can lead to a complete dismissal of all charges for his clients, ensuring they are not only protected from financial loss but also from the burden of costly legal battles stemming from breached contracts.

The Financial Impact: Cost of Litigating Breach of Contract

When a securities scam is exposed, the financial impact can be devastating for both individuals and institutions. One significant consequence is the high cost of litigating a breach of contract. These cases often involve complex legal battles, with extensive documentation and expert testimony required to prove wrongdoing. The stakes are particularly high in high-stakes cases, where millions of dollars may be at risk. As such, the financial burden of litigation can be substantial, with fees for legal representation, court costs, and potential damages adding up quickly.

The process is further complicated by the need to navigate a labyrinthine legal system, especially when dealing with jury trials. The time and resources required to secure a favorable outcome in these cases can strain even the most well-resourced philanthropic and political communities. Consequently, many victims opt for out-of-court settlements, which may not fully compensate them for their losses but provide some measure of closure and prevent the prolonged and costly legal battles that often characterize high-stakes cases.

Protecting Yourself: Strategies to Avoid and Report Fraudulent Activities

Protecting yourself from securities scams involves a combination of awareness and proactive measures. Always be cautious when encountering investment opportunities that promise quick or excessive returns, as these are common red flags for fraudulent activities. Thoroughly research any individual or company offering financial schemes before providing any personal or financial information.

If you suspect a breach of contract or encounter white-collar criminal defense scenarios, acting swiftly is crucial. Reporting suspicious activities to the relevant authorities and seeking legal counsel can help mitigate potential losses and secure a complete dismissal of all charges. Remember, staying informed about common scams and understanding your rights as an investor are essential tools in safeguarding your financial interests. Additionally, keeping detailed records of all interactions related to investments can serve as invaluable evidence if you need to pursue legal action, potentially reducing the cost of litigating a breach of contract.

Securities scams are a significant threat, but with the right knowledge and precautions, investors can protect themselves. By understanding common schemes and implementing protective strategies, we can mitigate financial losses. Remember, awareness is key in navigating the complex world of investments. Stay vigilant, report suspicious activities, and be mindful of potential frauds to safeguard your financial future. Additionally, recognizing the financial implications, such as the cost of litigating a breach of contract, can further empower individuals to make informed decisions and avoid becoming victims.